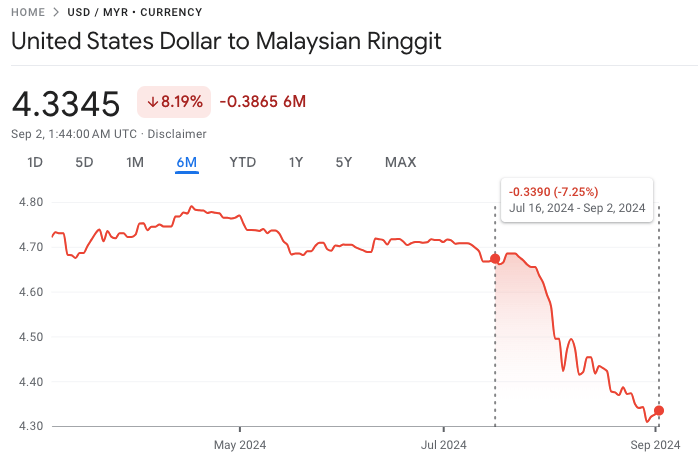

The Malaysian Ringgit began strengthening significantly against the US Dollar from around mid-July this year. It went from RM 4.67 for 1 US Dollar then to RM 4.33 for 1 US Dollar today. This means if you hold Malaysian assets, the asset value has increased by 7% in about 90 days when it is valued in US Dollar. In the same way, if you hold US assets, the asset value has dropped by 7% when valued in Malaysian Ringgit.

If you spread your investments across different countries, your investment returns will inevitably be affected by changes in the exchange rates. Using the example of US assets and Malaysian assets above, you will feel slightly poorer if you sell your US assets and spend Ringgit in Malaysia. However, if you do the opposite and sell your Malaysian assets to spend Dollars in the US, you will feel just the opposite.

Diversifying Investments Internationally

Why would we need to invest in different countries if exchange rate changes can affect our returns? There are two good reasons in my view.

- Better investment returns from another country

The all time high of the KL Composite Index was nearly 1,900 about 10 years ago. Today the index is 12% below this peak. During this same 10 years, the S&P 500 of the US had risen 250%. It would have been foolish to not allocate some investment to the US stock market to take advantage of this growth. This is exactly what the EPF of Malaysia does as they have steadily increased overseas investment since the 2000s. - Retirement in a different country

Understandably, this reason does to apply to most people. But some Malaysians dream of migrating to neighbouring Singapore or even Australia. Our investments ultimately fund our retirement life. Hence it makes sense to have some of that investment allocated to where we will be spending our retirement. This safeguards the portion of the investment from near term currency exchange fluctuations. Besides you also need some funds to be easily accessible in case of emergencies.

How Currencies Work

Currencies offer the perfect medium of exchange for daily transactions. These days, we hardly need to bring physical currencies as it appears as just digital numbers on our electronic devices.

When transactions cross international borders, currencies become somewhat like a state-controlled digital commodity that can be bought and sold. If a Malaysian company wants to pay a Chinese company in Renminbi out of its Ringgit bank account, the bank of the Malaysian company first needs to sell Ringgit and buy Renminbi in the foreign exchange market. The exchange market matches the Malaysian bank with a Chinese bank that wants to do the reverse – buy Ringgit and sell Renminbi. Both banks agree on the exchange rate to make the transfer and their computers record the transaction and their new account balances digitally. Now the Malaysian bank has Renminbi to send to the bank of the Chinese company.

This supply and demand of currencies is what determines their exchange rates. If there are a lot of Malaysian companies that want to pay in Renminbi compared to Chinese companies that want to pay in Ringgit, then the demand of the Renminbi will cause the exchange rate to favour the Renminbi – more Ringgit will be needed to buy the same amount of Renminbi.

Currencies are invented by a sovereign state and it can be created, controlled and reduced by the state at will. This type of currency is called fiat currency – the currency is acceptable as a medium of exchange for transactions as long as there is faith that the state will keep the value of the currency stable and honour the debts denominated by its currency.

When an exchange rate changes too quickly, the central bank of the state can step in to stablise the situation by buying or selling its reserves of foreign currencies in the foreign exchange market. In extreme situations, the central bank could impose capital controls as Malaysia did in 1998 (by restricting the selling of Ringgit in the foreign exchange market) or increase the supply of its own currency by simply creating more of it.

The US Fed, which performs the central bank function in the US, dramatically increased the supply of US Dollars in 2008, 2010 and 2020 in response to crises then. Normally, any country that creates voluminous amounts of its currency will quickly devalue that currency since there is more supply of the currency than demand. However, that did not happen to the US Dollar as the excess supply was absorbed just as quickly by the deep international financial markets that operate mostly with the US Dollar.

Long Term Trend of Ringgit and US Dollar

For the past 30 years, the Ringgit has devalued against the US Dollar. Back in the 1990s, you can exchange RM 2.50 with 1 US Dollar. Today you will need RM 4.33 for the same 1 US Dollar. The overall demand to exchange Ringgit with the US Dollar has been high for a long time.

Why is this so? Malaysia’s exports are largely manufacturing (electrical and electronics) and commodity (oil, natural gas and palm oil) based. With the exception of the palm oil, these exports are likely paid for in US Dollars and not Ringgit. Malaysian companies would have to convert their US Dollars earnings into Ringgit and bring Ringgit back to Malaysia for there to be demand for Ringgit. But these companies might prefer to keep their earnings overseas in US Dollar to pay their foreign suppliers in US Dollars or to invest in the liquid US Treasuries.

There is therefore a structural trend for Ringgit to continue devaluing against the US Dollar. Malaysia may counter this by having a continuous flow of foreign direct investments that would create a demand for Ringgit. However the massive 1MDB corruption scandal that resulted in a change of government in 2018 and the instability of subsequent governments had seriously dented investors’ confidence with the governance of the country. It’s only this year that Malaysia has started to see foreign investors coming back.

What’s Next?

For Malaysians investing in foreign listed shares, the recent strengthening of the Ringgit gives an opportunity to buy more foreign shares without needing more Ringgit. Taking the example of US equities, in the long run one can gain from the potential appreciation of the share price as well as the strengthening US Dollar when compared to the Ringgit.