The Employees Provident Fund or EPF is Malaysia’s statutory solution for retirement savings. Every salaried employee and his/her employer is mandated by law to contribute into this fund. The fund takes the contributions and invests generally in equities, fixed income, and real estate. These investments are made both within and outside of Malaysia.

At the start of every year, the fund declares a dividend, which it adds to the employee’s EPF account. This dividend comes from the profits that it realizes from the investments in the year before. And thus lies the root of the problem: to realize a profit, especially from capital gains, it must sell its investment.

EPF’s 2024 Annual Report

EPF has recently and quietly published its 2024 annual report on its website. Buried in the 300+ pages are the financial statements of the fund – crucial information that draws hardly any scrutiny from news outlets, national leaders and politicians.

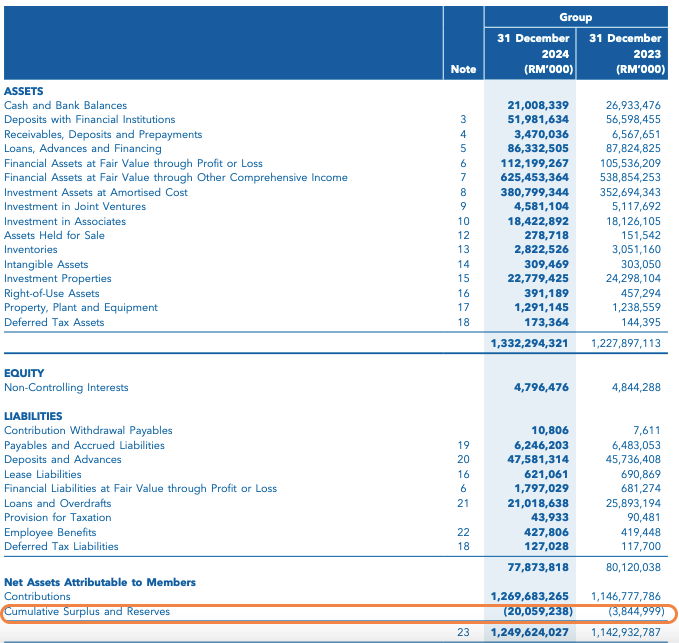

The financial statements show that at the end of 2024, the total amount sitting in all the employees’ EPF accounts was RM 1.27 trillion. Still, the fund also had RM 20 billion of deficit in its cumulative “surplus” and reserves account. This meant if it sold every investment to pay back the account holders, it was still short by RM 20 billion. And this was a bigger deficit than the RM 4 billion back in 2023.

Source: EPF 2024 Annual Report – Balance Sheet

If 2024 Was A Good Year for Equities, Why Did The Deficit Grew?

Imagine EPF owning a bunch of stocks, some have unrealized gains while some have unrealized losses. Since EPF can only declare its dividend from realized profits, it has to sell the stocks having gains to realize (lock in) the gains. This leaves it holding mostly the stocks with unrealized losses.

The situation is made worse when there is anticipation (political or otherwise) of the EPF declaring a high dividend when there are big gains in equities like in 2024. Akin to prematurely killing the golden goose, EPF would be forced to sell its winners in 2024 just to make the dreams of those people come true.

As seasoned investors would know, you can’t time the market. It is impossible to consistently find the top or the bottom of the market. Once you have sold off your winners, you can’t always buy it back at a lower price. Furthermore, in markets like the US, where EPF has exposure, selling off and buying back a stock instantly triggers the wash sale rule. This leads to a negative tax impact to EPF.

Again I have to remind readers of this quote from Charlie Munger:

The first rule of compounding: Never interrupt it unnecessarily – Charlie Munger

EPF Account Holders Should Expect Lower Dividends

EPF’s management must surely know this situation is untenable. A collapse of the EPF fund will have disastrous effects. It will impact its nearly 9 million active contributors and affect Malaysia’s stock market. The EPF fund is almost 3 times Malaysia’s 2025 federal budget. The government will be unable to save the EPF.

EPF management needs to grow a backbone. They should stand up to the politicians who always make things worse. They must inform account holders to expect much lower dividends in the years to come.

Even in a stellar year for equities, EPF must declare a low dividend. It must let the unrealized gains compound over time. Only then will its reserves to build back up again. And ample reserves is absolutely necessary to sustain EPF’s dividends in times of recession.