EPF of Malaysia just released its 2023 Annual Report on 30 October 2024. It is astounding that it took such a prominent entity in Malaysia almost a year to release this report. I guess most Malaysians do not read the annual report of their retirement savings fund. Otherwise they may be wondering what’s the big hold up? Most of the provident or government pension funds in other countries have released their annual reports months earlier.

A Bit Of History from 2018

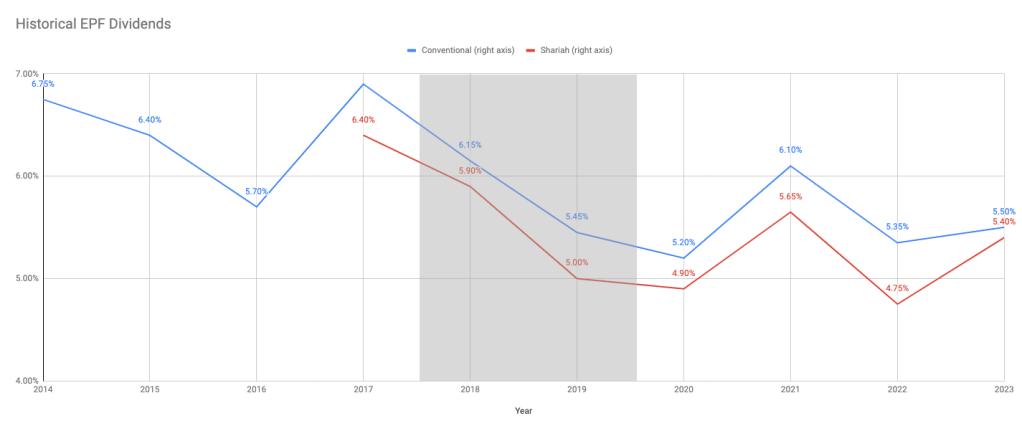

EPF announced a surprisingly high dividend of over 6% for 2018. Since then, I have been tracking its balance sheet from the annual reports. You would recall 2018 was notoriously bad for stock markets worldwide. The KLCI dropped almost 6% while the MSCI world index dropped 8%. Hence it was illogical for EPF to announce such a high dividend for 2018. This dividend matched the dividends of prior good years.

EPF Dividends announced from 2014 to 2023. Shaded area are years when the Malaysian KLCI dropped more than 5%.

For the EPF to pay the 6% dividend it had to come up with RM47 billion. It already had RM31 billion in the pocket from its net profit. But it needed to make up the difference of RM16 billion. It achieved this by selling RM159 billion worth of shares which generated RM18 billion in profit.

If EPF aims to maximize the returns of the retirement savings as a long-term objective, then why does it sell so many shares during a market downturn? That made no sense to me.

The first rule of compounding: Never interrupt it unnecessarily

– Charlie Munger

What would have made sense is to announce a much lower dividend and blame it on the market downturn. Everyone would have understood it. A lower dividend would mean not needing to sell shares in a falling market. Instead, the members’ monthly contributions could be used to buy them cheaply. When the market eventually turns around, and it did in 2020, everyone would benefit more.

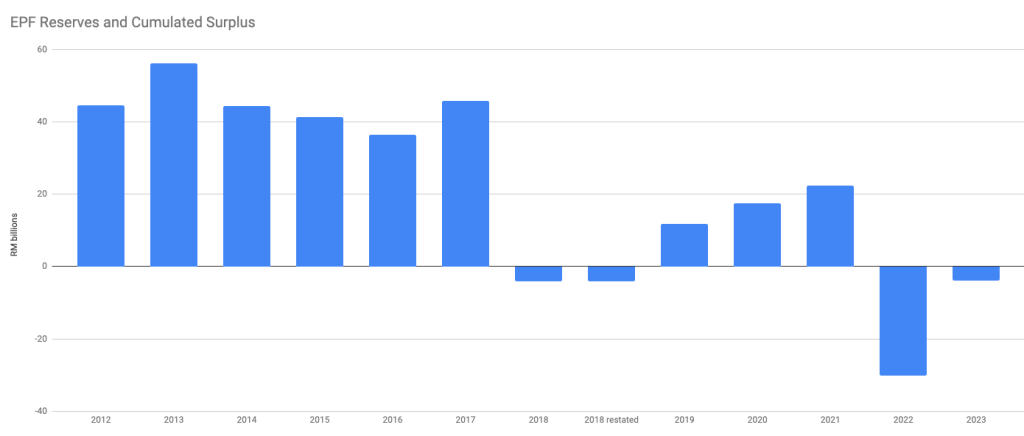

Impact to the Cumulative Surplus and Reserves

The 6% dividend dramatically drained the cumulative surplus and reserves of the EPF’s balance sheet. (The cumulative surplus and reserves comprise mainly of unrealized gains or losses on EPF’s investments.) It went from almost positive RM46 billion (healthy 6% of unrealized gains on the members’ contributions) to negative RM4 billion (0.5% unrealized loss on the members’ contributions). In other words, its investment portfolio was under water in 2018.

Slowly, EPF clawed back its reserves in 2019, 2020 and 2021. By 2021, its cumulative surplus and reserves went up to RM22 billion. This translated to about 2% of unrealized gains on the members’ contribution.

Alas, the government made a series of bad decisions in 2022. They allowed repetitive and unconditional withdrawals of EPF members’ savings. These actions dragged EPF’s balance sheet back into the dumpster. Mainly the poorest EPF members withdrew a total of RM44 billion. This left them with next to nothing for their retirement years.

On top of this, EPF announced a dividend of 4.75% and 5.35% for the Shariah and Conventional accounts, which meant another RM51 billion had to be found.

The RM44 billion unplanned withdrawal caused EPF’s cumulative surplus and reserves to register negative RM30 billion in 2022. This is the lowest I have seen from all EPF annual reports since 2001. This translated to a 3% unrealized loss on the members’ contributions.

2023 Annual Report

This is why I was looking forward to the 2023 Annual Report. I wanted to find out how far the EPF has achieved in rebuilding its reserves.

In 2023, EPF was registering record profits. The Malaysian stock market was flat in 2023. However, its biggest equities investment overseas was in the US. In the US, the NASDAQ and S&P 500 registered 45% and 24% growth respectively. EPF earned RM42 billion in net profit. It also earned another RM23 billion from the sale of equities. However, the fund was only going to pay out RM58 billion in dividend after announcing a 5.5% and 5.4% dividend for Conventional and Shariah accounts.

The cumulative surplus and reserves of the EPF is still a negative amount of RM4 billion. This represents about a third of a percentage of unrealized loss on the members’ contribution. It is an improvement but shows that EPF is still not out of the woods. The EPF should be patient. It needs to wait until the unrealized losses on its equity investments are reversed. It should also reduce selling shares for short-term gains. It needs to rebuild its reserves and that means keeping low dividends in the coming years.

EPF Reserves and Cumulated Surplus from 2012 to 2023

This is a tough medicine for many EPF members to take. More people need to understand EPF’s balance sheet. They should know how its investments are performing. This way, they are not hoodwinked by unsustainable dividends.

[…] suppose the EPF dividend for 2024 would be around that or lower because it should rebuild its reserves having allowed a massive RM 44 billion early withdrawal by its members in […]

LikeLike