The Employees Provident Fund or EPF is Malaysia's statutory solution for retirement savings. Every salaried employee and his/her employer is mandated by law to contribute into this fund. The fund takes the contributions and invests generally in equities, fixed income, and real estate. These investments are made both within and outside of Malaysia. At the… Continue reading Why EPF’s 2024 Report Signals Lower Returns

Category: Personal Finance

Inflation and Retirement

It has been a while since my last post. I remind myself that I started this blog as a personal journal of my thoughts but have been too busy to write. Now I am in the holiday period at the end of 2021 and I finally found the time to write again about some interesting… Continue reading Inflation and Retirement

2020 Stocks Review

Photo by Kelly Sikkema on Unsplash 2020 proved that you can never really predict what's going to happen in the stock market or the economy. As we all remember, there was a flash of panic in March due to the Covid-19 pandemic but things quickly recovered as central banks around the world printed trillions in… Continue reading 2020 Stocks Review

Timing The Market

Timer Photo by Marcelo Leal on Unsplash The Coronavirus pandemic has created a unique situation in the global economy. Fear of recession is clearly reflected in the sharp drops in the yields of bonds and treasuries and surges in gold prices. Money is moving from riskier asset classes like stocks into these asset classes instead. In Malaysia, the… Continue reading Timing The Market

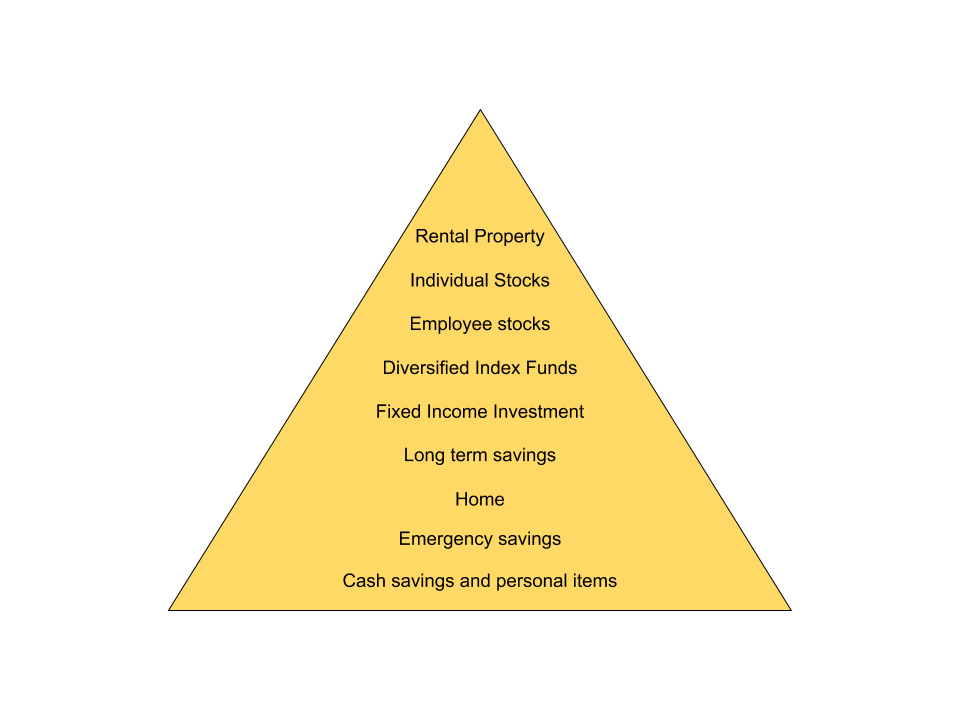

The Long Journey to Financial Freedom

It is not uncommon to hear from those who are tired of their jobs that they wished they could simply stop and do something else that they might enjoy. However, reality usually strikes them in the form of bills and/or mortgages to be paid. So they simply suck it in and continue with the drudgery… Continue reading The Long Journey to Financial Freedom

EPF’s Belanjawanku And Those Who Do Not Need It

Last week on March 4th, the EPF published an expenditure guide called 'Belanjawanku', which is 'My Budget' when translated from Malay. When I heard the news I knew it would be a lightning rod attracting criticism. Source: http://www.kwsp.gov.my/portal/documents/10180/6462229/Panduan_Belanjawanku_03032019.pdf And indeed it did. For example, people mocked that it's impossible to find a rental room in… Continue reading EPF’s Belanjawanku And Those Who Do Not Need It

Investing In Properties

We are now approaching to the top of the asset allocation model and the ninth layer concerns properties bought for the purpose of investment. I mentioned that the risks involved with investing increases as we go up the layers of the model. I'll talk more again about the risks associated with property investments later on.… Continue reading Investing In Properties

Avoid the Private Retirement Schemes (PRS) Funds

The Employees' Provident Fund (EPF) of Malaysia has long been criticised for offering a one sized fits all retirement savings solution for all Malaysians. It has only one fund for all its contributors aged from the 20s to 50s. Everyone gets the same return every year. Ideally, younger contributors should be able to put their… Continue reading Avoid the Private Retirement Schemes (PRS) Funds

It Is Always Possible To Save

Aiya! Easier said than done you might say. But, you have to start somewhere right? Having a positive mindset is a good place to start. Then the trick is to keep going until saving becomes a habit. Push your savings to work for you by investing it. Better still, find a way to automate everything,… Continue reading It Is Always Possible To Save

Should You Pick Stocks?

The next two layers of the 'asset allocation model' concerns buying and holding individual stocks as part of your strategy to growth your wealth. The risks involved are much higher and concentrated at these levels, so it would be best to only start allocating money to this level, once you have appropriately mastered and allocated… Continue reading Should You Pick Stocks?