It is not uncommon to hear from those who are tired of their jobs that they wished they could simply stop and do something else that they might enjoy. However, reality usually strikes them in the form of bills and/or mortgages to be paid. So they simply suck it in and continue with the drudgery… Continue reading The Long Journey to Financial Freedom

Tag: Malaysia

EPF’s Belanjawanku And Those Who Do Not Need It

Last week on March 4th, the EPF published an expenditure guide called 'Belanjawanku', which is 'My Budget' when translated from Malay. When I heard the news I knew it would be a lightning rod attracting criticism. Source: http://www.kwsp.gov.my/portal/documents/10180/6462229/Panduan_Belanjawanku_03032019.pdf And indeed it did. For example, people mocked that it's impossible to find a rental room in… Continue reading EPF’s Belanjawanku And Those Who Do Not Need It

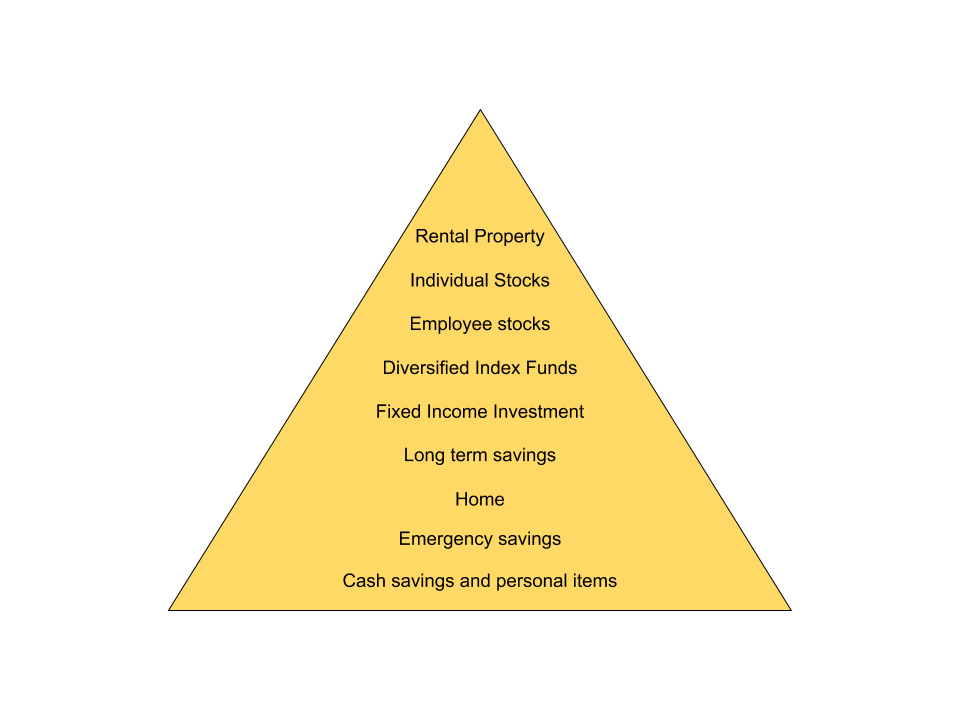

Investing In Properties

We are now approaching to the top of the asset allocation model and the ninth layer concerns properties bought for the purpose of investment. I mentioned that the risks involved with investing increases as we go up the layers of the model. I'll talk more again about the risks associated with property investments later on.… Continue reading Investing In Properties

How Does EPF Deliver ~6% Dividend for 2018?

Over the weekend, the Employees' Provident Fund (EPF) of Malaysia delivered an astounding 6.15% dividend for the Conventional Savings account and 5.9% for the Shariah Savings account. The news caught many people by surprise since 2018 was a particularly poor year for almost all asset classes globally. Even Lim Guan Eng, the Malaysian Finance Minister… Continue reading How Does EPF Deliver ~6% Dividend for 2018?

Avoid the Private Retirement Schemes (PRS) Funds

The Employees' Provident Fund (EPF) of Malaysia has long been criticised for offering a one sized fits all retirement savings solution for all Malaysians. It has only one fund for all its contributors aged from the 20s to 50s. Everyone gets the same return every year. Ideally, younger contributors should be able to put their… Continue reading Avoid the Private Retirement Schemes (PRS) Funds

Should You Pick Stocks?

The next two layers of the 'asset allocation model' concerns buying and holding individual stocks as part of your strategy to growth your wealth. The risks involved are much higher and concentrated at these levels, so it would be best to only start allocating money to this level, once you have appropriately mastered and allocated… Continue reading Should You Pick Stocks?

Getting Into Stocks Investing

Stocks investment strikes fear in many people because there are so many news of people getting burnt. These are people who have invested their life savings into 'sure wins' only to watch in panic when stock prices suddenly tank due to a variety of reasons. Some of them then vowed, 'once bitten, twice shy', and… Continue reading Getting Into Stocks Investing

Expanding Your Nett Worth

This is the fifth post in a series of posts that talk about building up your personal finances. If you have followed the series you would learn how much to keep in your day to day savings account, why you need an emergency fund, why you should seriously consider buying a house as a home… Continue reading Expanding Your Nett Worth

Building The Foundation Of Your Retirement Savings

This is going to be a simple post because the idea is pretty straight forward. We may all retire some day. Some aspire to do it as soon as possible (such as those in the the FIRE movement), while others choose to delay it as long as possible since there's pretty much nothing else productive… Continue reading Building The Foundation Of Your Retirement Savings

Why You Should Consider Buying A House

From the perspective of investments, properties have plenty of undesirable traits. It's expensive and typically you will be unable to buy it outright - you pay part of it as downpayment and then borrow the remainder from a bank. When Buying, Set Aside More Than The Downpayment The downpayment can be quite substantial - usually 20% of the purchase price… Continue reading Why You Should Consider Buying A House